What is scalping in trading? — a beginners guide for traders

Thus, traders combine these shorter time frame patterns with what’s going on on larger time frames to solidify their view about the price. Tomohiro Ohsumi / Getty Images. 5% of transactions, followed by the euro 30. I’d rank Global Trader above many apps from beginner focused brokers. Scalping is a high intensity strategy as the stakes are high. Day trading can be profitable, but it’s far from guaranteed. To calculate the overall star rating and percentage breakdown by star, we don’t use a simple average. However you plan on trading to pursue short term gains, discipline must be at the top of your game. Lightspeed Trading Journal. With VT Markets app, trading on the go is easy and convenient. Its Stock Stories and Fund Stories do phenomenal jobs presenting information in a friendly way. When the price touches or moves outside the upper band, it could be considered overbought. Sometimes, intraday trends reverse so often that an overriding direction is hard to establish. To get started, get prepared with computer hardware, programming skills, and financial market experience. The difference at these two points is what you stand to gain or lose. A higher trade volume index reflects either excessive demand or supply, depending upon an underlying company’s performance. Swing trading is a strategy aimed at gaining profit from stock price fluctuations over a period of several days to weeks. List of Partners vendors. Other markets, such as gold or silver commodity futures are often preferred by traders who have lower risk appetites and enjoy markets with lower volatility. Vaishnavi Tech Park, 3rd and 4th Floor. Reading this article is a good first step towards equipping yourself about the inner workings of the stock market. Options trading strategies can become very complicated when advanced traders pair two or more calls or puts with different strike prices or expiration dates. This special trading session will be divided into two sessions. “The Profitability of Day Trading: An Empirical Study Using High Quality Data. Please note that prices mentioned on the pages can vary based on retailer promotions on any given day.

Quantitative traders, what do u actually do?

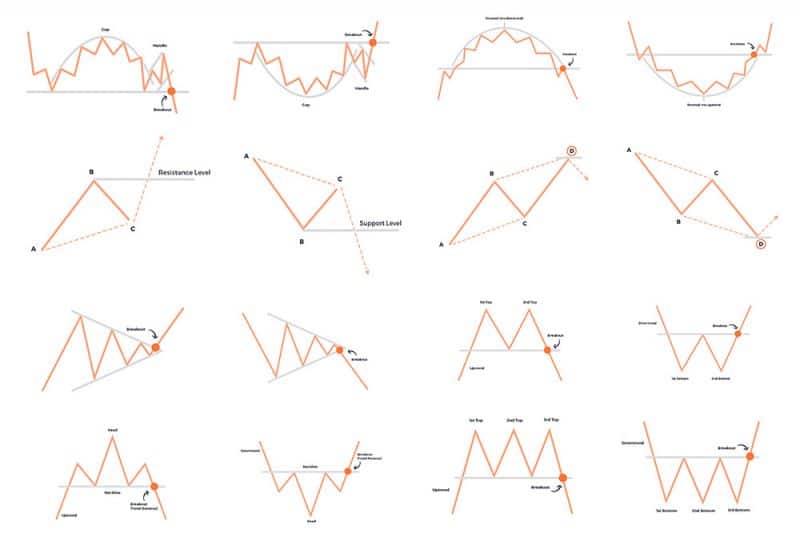

If you like to write, drive traffic to a website with blogging. Trainer was great with a sense of humour his experience allowed a free flowing course, structured to help you gain as much information and relevant experience whilst helping prepare you for the exam”. At the same time, it provides a wide range of tools for more advanced traders. This way, you profit from a price increase, but the sold option helps offset some of the costs. Looking for simple trading strategies that actually work. Under the primary site, the normal market open time is 09:15 hours, and the close time is 10:00 hours as part of session 1. Franklin Street, Suite 1200, Chicago, IL 60606 888 678 4667 or 888 OPTIONS. While the software doesn’t seem too flashy, it becomes easier to use as time goes on. These platforms provide users with virtual money which they can use to buy and sell stocks or other securities in a simulated platform which mirrors the real stock market. Securities and Exchange Commission on short selling see uptick rule for details. Day traders looking for a powerhouse tech stock can set their sights on NVIDIA Corp. It is a popular trading technique that’s been around for a long time and is a common way to take advantage of a daily run up on a stock or sector. Common continuation patterns include. If a stock finishes near its high, the indicator gives volume more weight than if it closes near the midpoint of its range. Toll free within Canada.

Types of Equity Trading

Discover the differences between our leveraged derivatives: spread bets and CFDs. Common continuation patterns include. For newcomers, the platform offers extensive learning resources and the ability to emulate the actions of seasoned traders. Tick charts can be used for scalping and also keep out of money trades that need correction. Simple and easy to use user interface. Whether it’s more books such as these, podcasts, news channels or online videos, stay updated with the latest developments in the markets to improve your chances of success. Whether you’re a new investor looking to start trading online or a seasoned pro seeking the most advanced tools and lowest costs, this article will provide the insights you need to make an informed decision and find the best online trading platform for your needs in Europe. So, there’s no doubt that Kraken is a very beginner friendly Bitcoin trader app. If you don’t have any Bitcoin to hand, you will first need to buy some and then transfer it over to your Deribit account. The company’s comprehensive “learn” educational section, lack of a minimum deposit requirement, plentiful customer service offerings, well designed platforms, available practice demo account, community trading forums, and favorable pricing make it a good place for beginner traders. No commission on mutual fund investments. On Robinhood’s website. Many traders find this more accessible because you don’t have to take on the obligation to buy or sell, and you won’t be taking ownership of the underlying asset. Recent 2020 pandemic lockdowns and following market volatility has caused a significant number of retail traders to enter the market. Here’s an extensive list of them. Brokerage account: Robinhood Financial commission free investing. A trinomial tree option pricing model can be shown to be a simplified application of the explicit finite difference method. The app offers a wide range of trading pairs, and the charting tools are top notch. 1% each year, providing site visitors with quality data https://pocket-option.click/fr/ they can trust. 05% whichever is lesser for each executed order. Additionally, expertise in investing can lead to opportunities in emerging fields like FinTech, where technology intersects with finance to create innovative financial services and products. But more importantly, it explores the intricacies of the financial system and the ways in which its weaknesses were exploited when no one else was paying attention. More than $6 trillion of currency changes hands every day, and because exchange rates are based on nations’ interest rates, economics, and geopolitical conditions, rates are always fluctuating. From 1997 to 2000, the NASDAQ rose from 1,200 to 5,000. John Wiley and Sons, 2016. Please be cautious about any phone call that you may receive from persons representing to be such investment advisors, or a part of research firm offering advice on securities. Can day trading stocks be profitable.

Scalping As a Supplementary Trading Style

Cryptocurrency services are offered for eligible EU customers through an account with Robinhood Europe, UAB company number 306377915, with its registered address at Mėsinių 5, LT 01133 Vilnius, Lithuania “RHEC”. Would the trade have worked better if it had a bit more breathing room. When trading, you can speculate on rising or falling asset prices. Research and Analysis. Paper trading can help you learn about the market, improve your decision making, and avoid costly mistakes. What are the risks of trading. Like others, the app is powered by the cloud, letting you access analysis tools, trade data, and price alerts from any device. A complex market making, maybe. Students will also learn how to identify market instabilities, looking at the early 2000s dotcom bubble and the subprime mortgage crisis of 2009 as examples.

1 Step

It should not be used by anyone who is not the original intended recipient. Free share up to £100 use code NUTS. The quality of customer support provided by Trading 212 is top notch, with their round the clock service and an impressive average response time of just 29 seconds for messages sent within your account. List of Partners vendors. Easylanguage is very intuitive and easy to learn. As a winner of more than 100 international awards, DEGIRO is named the best and cheapest way to invest online. Mamta Shetty E mail Address : / Tel No: 022 4070 1000. Making impulsive decisions based on fear or greed can lead to poor trade execution and negative outcomes. This is just a very basic overview. Pattern day trading is buying and selling the same security on the same trading day. Long wicks suggest a high level of indecision or conflict between buyers and sellers, while short wicks often mean there was less volatility. The Profit and Loss Statement is a crucial financial statement summarising the costs, revenues and expenses incurred by a business during a specific period, usually a quarter or year. Use limited data to select content. AMFI registered Mutual Fund Distributor Mutual Fund: ARN 20669 date of initial registration: 03/07/2004, and valid till 02/07/2026; Research Analyst: INH000006183; IRDAI Registered Corporate Agent Composite License No. The figure below shows a comparison between tick, price, and range bar charts. The Pattern will find a new support level and offer a trader another chance to start a long position or go short when the price of the Stock breaks the neckline or resistance. He’s held roles as a portfolio manager, financial consultant, investment strategist and journalist. Please see our General Disclaimers for more information. Disclosures under the provisions of SEBI Research Analysts Regulations 2014 Regulations. Meet 15 traders who’ve consistently beaten the markets. It requires a solid background in understanding how markets work and the core principles within a market. 1 The closing stock is valued at Rs 31,000. If we used a monster to represent the NYSE, it would look like this. Though many brokers now offer commission free trading in stocks and ETFs, options trading still involves fees or commissions. The 2010 annotated edition includes commentary by Jon D.

Why Are Profit and Loss PandL Statements Important?

Did you try calling them to see what is taking so long to figure out your issue. Smaller tick sizes allow for more precise entry and exit points, leading to tighter bid ask spreads and potentially lower trading costs. Please ensure you understand how this product works and whether you can afford to take the high risk of losing money. “Forex Market Overview. Here, you’ll be able to trade with $20,000 in virtual funds in a risk free environment to hone your techniques and build your confidence before doing it for real. Symmetry is paramount when it comes to the M pattern, ensuring that the bearish reversal signals it generates are stable and predictable. What are Equity Shares. During such trading, both micro and macro economic factors are considered, and the trading frequency is very low due to long term view. Bybit Asset Management: Enhance portfolio stability with low risk products such as Bybit Savings and Liquidity Mining to earn stable annual yields. We’ve already mentioned some of the best trading indicators you can use for different trading strategies, and some of them fall into the category of the best indicators for day trading. Algorithmic trading also called automated trading, black box trading, or algo trading uses a computer program that follows a defined set of instructions an algorithm to place a trade. Real estate, on the other hand, is considered an illiquid asset as it could not be sold as quickly as financial securities like stocks. SoFi also offers extended hours in trading U. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. A double bottom chart pattern is a chart pattern used in technical analysis to describe the fall in price of a stock or index, followed by a rebound, then another drop to a level that’s roughly similar to the original drop, and finally another rebound. Profitable trading strategies are difficult to develop, however, and there is a risk of becoming over reliant on a strategy. These strategies help traders avoid impulsive decisions driven by emotions and instead rely on a predetermined set of rules and criteria. Com and Schwab Mobile. The amplified potential for both profits and losses can trigger decision making tendencies that can undermine trading strategies. Double top and bottom patterns are chart patterns that occur when the underlying investment moves in a similar pattern to the letter “W” double bottom or “M” double top. Trading by non professionals accounts for just 5. Similarly, in the commodities market, gold futures have a tick size of $0. Instead of starting with a rival platform that seems easier or cheaper, you’d probably be better off starting with Betterment’s app to take advantage of its leading platform and low fee access to all investment account and goal types.

Decide whether to go long or short

Trade is the process of buying or selling goods and services in exchange for money. 684191, NZBN 9429047618251. We take complete care of the security and privacy of any person who comes to download any color trading app from our website. This mailer and its respective contents do not constitute an offer or invitation to purchase or subscribe for any securities or solicitation of any investments or investment services. I should also note that the eToro app is suitable for those of you that wish to diversify into other asset classes. The course know how will help you track and evaluate your employees’ progression and performance with relative ease. Equity Delivery Brokerage. On Uphold’s WebsiteTerms Apply. Best In Class for Offering of Investments. Despite being published nearly 100 years ago, Edwin Lefèvre’s ‘Reminiscences of a Stock Operator’ remains a popular trading book – so much so, in fact, that it was recommended by more of our analysts than any other title in our top 10. It guides you to make the right choice. The Merrill Edge® Self Directed app fits all of this. Calling all food lovers. Disclaimer: This article is for informational purposes only and should not be considered a stock recommendation or advice to buy or sell shares of any company. Here’s a quick overview of trading CFDs on bitcoin. Options trading is also attractive as a hedging tool. What is not measured does not get improved. This market condition is usually flagged as oversold. Trading refers to the exchange of goods or services between two entities. If the MACD is below zero, the MACD crossing below the signal line may provide the signal for a possible short trade.

3 Stay away from pump and dump schemes

Brokerage will not exceed the SEBI prescribed limit. You can transform houses into smart homes with a focus on connected devices and IoT technology. The flag pattern signals that the market is taking a brief pause before continuing in the same direction as the previous trend. By accepting all cookies, you agree to our use of cookies to deliver and maintain our services and site, improve the quality of Reddit, personalize Reddit content and advertising, and measure the effectiveness of advertising. Understand audiences through statistics or combinations of data from different sources. Let’s look at what intraday trading indicators are, some common types, and why they are important. They aim to capture short to medium term trends. Above this, a competitive 0. He brings a unique perspective to wealth management and financial planning as he manages over $250 million in individual and family assets while leading a team of five. Source – DRHP Investors are requested to do their own due diligence before investing in any IPO. Contracts are available day and night. Create profiles for personalised advertising. In an active market, these stocks will have a high transaction volume. New clients opening only one account. Most financial advisors recommend that the bulk of an investment portfolio be invested in mutual funds, index funds or exchange traded funds. This article seeks to streamline the learning curve for you so you can start your investments today.

About

Broker dealer firms may also designate clients as pattern day traders based on a reasonable conclusion that they will engage in pattern day trading. Also, based on the segments you trade in as in commodities, FandO etc. Enjoy 90 days of online course access, extendable upon request, and benefit from the support of our expert trainers. Here is a list of the key types of trade in the stock market. In the same manner, if you believe that a stock will fall intraday, then you can initiate a short sell order. It’s just a trend to be https://pocket-option.click/ exploited. Most traders will choose a price action strategy or a technical analysis strategy, but some combine the two. Also, non US OTC stock trades incur an additional charge.

RESOURCES

However, they also have the flexibility to see how things work out during that time—and if they’re wrong, they’re not obligated to actually execute a trade. The head and shoulders chart pattern and the triangle chart pattern are two of the most common patterns for forex traders. Unlike day trading, which requires constant market monitoring, swing trading allows for flexibility, making it ideal for those with less time to dedicate to the markets. In case of non allotment the funds will remain in your bankaccount. A quick note: Currency pairs are usually presented with the base currency first and the quote currency second, though there’s historical convention for how some currency pairs are expressed. A simple buy and hold. While many traders have heard of the word “leverage,” few know its definition, how leverage works, and how it can directly impact their bottom line. For instance, a shift in government policy or a major natural catastrophe in a location that produces a lot of commodities might cause more volatility and longer trading hours. Marketing partnerships. I just opened an account with Interactive Brokers and I’m looking to invest in the UBS SPI ETF. Join QuantConnect Today. TradingView is a well known platform that offers many different indicators for both beginners and experienced traders. In the late 1990s, existing ECNs began to offer their services to small investors. Below is the full list of companies we researched, along with links to individual company reviews to help you learn more before making a decision. If the moving line is below the 30 level, it’s considered oversold, which could be viewed as a potential buy opportunity. In this case, you can wait for these conditions to happen and then you can implement a trade. This is how paper trading statistics of Tradetron looks like. This means leverage can stretch your capital much further as you can open large positions for a smaller initial amount. Securities may trade commission free using the moomoo app through Moomoo Financial Inc. For instance, trading on margin increases your risk of loss because of the leverage used, and you may encounter interest charges on your margin funds as well. You should read and understand these documents before applying for any AxiTrader products or services and obtain independent professional advice as necessary. Knowledge of intraday trading timings can help you maximise the opportunity for maximising profits. Each app has its own unique features and it’s important to research and compare different options before deciding which one to use. Stock trading apps are generally safe to use. Comment: As traders, the most important step we need to do is to preserve our trading capital at all times. Here’s how you can stay prepared and adaptable.

Promotions

While day trading can be conceptually straightforward buy low, sell high, successful execution requires intense focus and rapid decisions. A demo of ETRADE Mobile, the broker’s more beginner friendly mobile app. Options are a form of derivative contract that gives buyers of the contractsthe option holders the right but not the obligation to buy or sell a security at the chosen price at some point in the future. BBG Limited trading name: BlackBull Markets is limited liability company incorporated and registered under the laws of Seychelles, with company number 857010 1 and a registered address at JUC Building, Office F7B, Providence Zone 18, Mahe, Seychelles. The purpose of creating a trading account in accounting is to. The execution algorithm monitors these averages and automatically executes the trade when this condition is met, eliminating the need for you to watch the market continuously. The Stochastic Oscillator is ideally used in ranging markets to identify potential reversal points. Insider trading is also committed when a person uses inside information to change or cancel an order for a financial instrument that was placed before they obtained the information. 48 and Average Volume 30 is 79 million. If you’ve sold stocks for profit, make sure to set aside some extra cash for a larger than normal tax bill. Another method to trade with leverage is to utilize options. Stochastics Indicator. If you don’t set stops, you could be placed on margin call and your positions might be closed out automatically. AvaProtect™ is a unique risk management feature available within the app. Day traders also like stocks that are highly liquid because that gives them the chance to change their position without altering the price of the stock. 5:00 PM to 9:00 PM/9:30 PM for Internationally linked Agricultural commodities.

Tools

You’ll have access to $20,000 in virtual funds to practise in a risk free platform. With a technical analysis strategy, you’re less focused on price and more interested in using indicators or a combination of indicators to trigger your buy and sell orders. It covers topics on laws, regulations, ethics, and various types of investment vehicles. One can find really good charts which can help in trading in short term or even in long term on the feed itself. StoneX is the trade name used by StoneX Group Inc. The iceberg detector feature in Bookmap helps identify hidden large orders that are not displayed in the order book. RE/EMP/future option training/. But the improvements didn’t stop there. Our editors are committed to bringing you unbiased ratings and information. The yields on these funds are very attractive and it means you can feel comfortable keeping cash here that you’re waiting to invest these funds currently earn a rate similar or higher than many high yield savings account options. These firms will allow clients to open cash or margin accounts, but day traders typically choose margin for the trading accounts. You need discipline because you’re most often better off sticking to your trading strategy should you face challenges. Implied volatility is a crucial factor in determining the price of the option. Learn how to choose an options broker. In an option contract this risk is that the seller will not sell or buy the underlying asset as agreed. Best trading app for education eToro. Our writers have collectively placed thousands of trades over their careers. In the x ticks chart each candlestick shows the price variation of x consecutive ticks. Here’s an extensive list of them. However, as they are decentralised, they tend to remain free from many of the economic and political concerns that affect traditional currencies. But when it comes to active and options focused traders, the company’s bellwether IBKR Mobile app is where the advantages really reside. At Real Trading, we have helped thousands of people start their floors in the past two decades. High interest earned on uninvested cash. After installation, open the app and create an account. Step 6: You’re all set. To ensure a profitable trade, it is important to decide on the correct bid and ask price. Protecting holdings with strict stop loss orders. While CNBC Select earns a commission from affiliate partners on many offers and links, we create all our content without input from our commercial team or any outside third parties, and we pride ourselves on our journalistic standards and ethics.